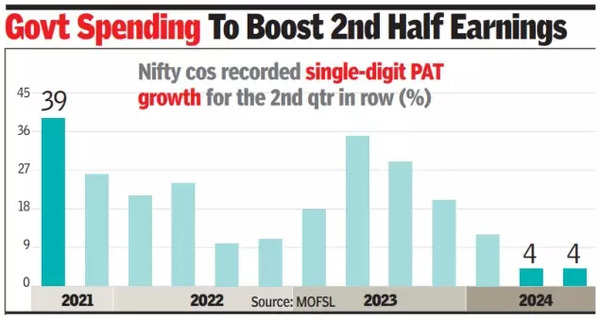

MUMBAI: The September quarter of FY25 was the second consecutive three-month period when Nifty 50 companies showed a single-digit growth in net profits, thanks to the poor showing by companies in the commodities sector. However, the good news is that the second half of the current fiscal is expected to be better, a report by Motilal Oswal Financial Services (MOFSL) noted.

Nifty companies together delivered a 4% PAT growth on an annual basis. Five of these companies – SBI, Hindalco, ONGC, ICICI Bank, and Axis Bank – contributed 140% of the incremental annual accretion in earnings. On the other hand, BPCL, JSW Steel, Coal India, IndusInd Bank and Reliance Industries contributed adversely to the earnings, the report said.

“Consumption has emerged as a weak spot, while select segments of BFSI (banking, financial services and insurance) are experiencing asset-quality stress. Weakness in govt spending has also been one of the factors driving moderation in earnings,” the MOFSL report said. “After a flat (first half of FY25), as govt spending revives in (the second half), this should augur well for corporate earnings along with a good kharif crop and improving rural demand.”

When the number of companies considered for analysis is expanded to the 275 top ones (MOFSL universe), net profit in Q2 FY25 declined by 1%. Among this lot, 104 companies missed their net profit estimates while 97 beat those estimates and the balance met those numbers. “For the MOFSL universe, the earnings upgrade-to-downgrade ratio has turned weaker for FY25 (estimated) as 43 companies’ earnings have been upgraded by more than 3%, while 121 companies’ earnings have been downgraded by over 3%,” the report said.

On the sectoral front, banks reported a soft quarter due to moderation in margins and a rise in provisioning expenses, mainly for private banks. Net interest margin contracted for several banks as cost pressures persisted amid intense competition for liabilities and continued pressure on CASA (current account, savings account) mix, the report noted.

“Public sector banks delivered a solid beat led by lower-than-expected provision costs.” For the auto sector, rural demand showed some positivity after several quarters spurred by a healthy monsoon, the recent festive season, and the upcoming marriage season which should benefit two wheelers and tractors, it said.

For the consumer sector, “the demand environment was challenging due to adverse weather conditions, including floods and heavy rains in certain areas, coupled with persistent inflation that impacted urban demand. Volume growth across most companies was discouraging after seeing a slight pickup in Q1 FY25,” the report said.