NEW DELHI: Brazil’s proposal to tax the super-rich is unlikely to be carried through when leaders of the G20 meet in Rio De Janeiro later this week as the original plan has been “significantly diluted” due to the stiff resistance from developed countries.

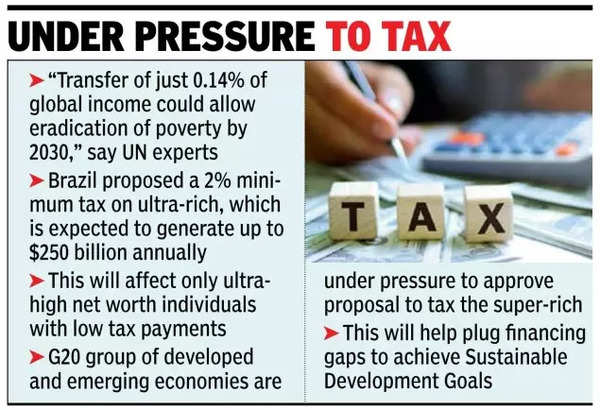

Under its G20 Presidency, Brazil had proposed a 2% minimum tax on the ultra-rich, which is expected to yield up to $250 billion annually and help greater global cooperation to end tax evasion. The proposal was based on a report prepared by French economist Gabriel Zucman.

The report refers to a progressive taxation approach that would affect around 3,000 individuals, who own fortunes of over one billion dollars – distributed in assets, real estate, shares and company ownership, among others – who do not yet pay at least 2% in annual income tax, according to a document on the G20 Brazil website. This, the report said, would affect only ultra-high net worth individuals with low tax payments.

“The proposal has been significantly diluted as the G7 countries have strongly opposed any such move,” said a source. The draft of the international declaration on taxes discussed at the finance track states that “with full respect to tax sovereignty we are seeking to engage cooperatively to ensure that ultra-high net worth individuals are effectively taxed.”

It also refers to the fact that these individuals are progressively taxed, while applauding “the domestic tax reforms carried out by several G20 countries to tackle inequalities and promote fairer and more progressive tax systems recently.”

Sources told TOI that intense discussions were underway to finalise a communique ahead of the leaders’ summit, which begins on Monday against the backdrop of geopolitical tensions and the aftermath of presidential election results in the US.

Pressure has been mounted on the G20 group of developed and emerging economies to approve the proposal to tax the super-rich and help plug the financing gaps in achieving the Sustainable Development Goals (SDG).

“Taxing the world’s billionaires provides an equitable pathway to generate much-needed additional resources to achieve the Sustainable Development Goals. A transfer of just 0.14% of global income could allow eradication of poverty by 2030,” UN experts said in a statement.